Every savvy retailer knows reducing risk is as important as growing sales. But what shields your business from unexpected mishaps while you focus on online sales and in-store foot traffic? Enter retail insurance.

Think of retail shop insurance as your business’s safety net. It’s there to catch those unexpected challenges before they threaten your business revenue.

Whether you host occasional pop-up shops or run a thriving ecommerce store, the right retail insurance helps your business run smoothly.

Here, we’ll demystify retail store insurance, outline its key components, and explain why it’s essential for every retailer.

What is retail insurance?

Retail insurance is a type of commercial insurance designed for retail businesses.

Retail insurance helps protect businesses from risks that can range from property damage to legal liabilities.

Some standard insurance for a retail store includes:

- Workers’ compensation insurance

- Business interruption insurance

- General liability insurance

- Cyber liability insurance

- Property insurance

- Crime insurance

The specific coverage a retail business may need depends on several factors, including:

- Physical business location

- Type of products sold

- Size of the business

It’s best to work with a licensed retail insurance agent to identify a policy that fits your unique needs.

Why retail insurance is important

Retail business insurance is important for managing risk and safeguarding the financial health of your business.

Here are seven reasons why retail business insurance is important:

1. Protection from financial losses

Whether it’s damage to property, theft, or a lawsuit, insurance covers these costs and prevents a business from facing crippling expenses.

2. Legal requirements

In some states, certain types of insurance, like workers’ compensation, are obligatory for businesses. Noncompliance may lead to fines, penalties, or legal consequences.

3. Improves credibility

Insurance makes a business look more legitimate and trustworthy in the eyes of stakeholders, customers, and suppliers. It shows a business is prepared to handle unexpected events properly.

4. Protection from lawsuits

Legal disputes are common in retail. Whether it’s an on-site injury or an issue with the product sold, insurance can cover legal fees and potential settlements, protecting the business from costly settlements.

5. Business continuity

If an unexpected event like a fire or flood prevents your business from operating as usual, you’ll receive compensation for lost income.

6. Employee protection

If employees suffer a work-related injury, there’s coverage for medical costs and lost wages. This not only protects employees but also shields the business from potential lawsuits from injured workers.

7. Peace of mind

Running a retail business means managing multiple tasks and responsibilities. Knowing that potential risks are covered gives entrepreneurs peace of mind so they can focus on growth and operations.

While retail insurance involves an upfront cost, the potential financial, legal, and reputational damages it prevents make it an essential investment.

What insurance is needed for a retail store

Retail store owners need to choose insurance that matches their unique needs and requirements.

Here’s a breakdown of 11 different types of retail insurance that a retail store may need:

1. General liability insurance

This is one of the most basic types of insurance all businesses should consider. It protects against bodily injury, property damage, and personal injury claims. For instance, if a customer slips and falls in your store, general liability insurance can cover their medical expenses and legal costs if they sue.

2. Property insurance

This covers damage to or loss of business property, which includes the physical building (if you own it) and its contents, such as inventory, fixtures, and equipment. It protects against perils like fire, storms, theft, and vandalism.

3. Business interruption insurance

This coverage, often a part of property insurance or a business owners policy, compensates for lost income and fixed expenses if you cannot operate due to a covered event like a fire or natural disaster.

4. Workers’ compensation insurance

If you employ staff, you’ll likely need workers’ compensation insurance. It covers medical expenses and a portion of lost wages if an employee gets injured or sick due to their job.

5. Commercial auto insurance

If your store owns and uses vehicles for business purposes, like delivery, you’ll need a commercial auto insurance policy to cover potential liabilities from accidents involving those vehicles.

6. Crime insurance

This protects your business from losses due to business-related crimes such as theft, fraud, or forgery.

7. Cyber liability insurance

If you conduct sales online or store sensitive customer information electronically, this insurance can cover costs related to data breaches, including notification costs, public relations efforts, and legal fees.

8. Equipment breakdown insurance

This covers the repair or replacement of equipment that breaks down, such as point-of-sale systems, refrigeration units, or other machinery.

9. Employment practices liability insurance (EPLI)

This protects your business from claims made by employees related to discrimination, wrongful termination, harassment, and other employment-related issues.

10. Product liability insurance

If you sell products, there’s always a chance they might cause harm or injury. Product liability insurance can cover legal fees and damages if someone claims a product you sold injured them or caused property damage.

11. Tenants legal liability insurance

If you lease your retail space, this coverage can protect you if you’re found responsible for causing damage.

Types of retail business insurance

The format and environment of your retail business influence which is the right type of insurance for you.

Here are three types of retail businesses and the specialized retail business insurance they may need.

1. Brick-and-mortar retail insurance

Brick-and-mortar stores are physical retail stores that customers visit in person. These retail spaces have comprehensive insurance needs:

- Crime insurance

- Property insurance

- General liability insurance

- Business interruption insurance

- Workers’ compensation insurance

When it comes to commercial insurance for your physical retail store, the biggest difference in your approach will depend on whether you lease or own the building, says Dave Zappacosta, principal agent at Bridge First Insurance.

“You either need to insure the building because you own it, or most leases have a built-in insurance requirement and may require more insurance than necessary.”

Different policies cover each scenario.

While your space may be one of your most valuable assets, the lifeline of your business is your product.

“The biggest concern for most [store] owners would be their inventory, especially in a store,” says Dave. “You want to make sure you know your numbers and purchase the correct amount of business personal property coverage.”

2. Pop-up shop retail insurance

Pop-up shops are temporary retail spaces that operate for a short period, often in rented venues or shared spaces.

Their unique nature requires specialized coverage:

- Short-term general liability insurance

- Tenant’s legal liability insurance

- Event cancellation insurance

- Property insurance

Remember how protecting your product is one of the most important considerations when shopping for commercial insurance? If you open a pop-up shop, that coverage doesn’t always carry over.

“For pop-ups, your inventory isn’t automatically covered,” says Dave. “Most business personal property coverage has a restriction of 1,500 feet within the main premises.”

The location of the pop-up, the means of travel, and who’s working it determine what types of additional commercial insurance are needed.

“If you’re traveling with your inventory, then you need to purchase an inland marine policy which covers business personal property away from the premises,” Dave says. “Most policies will have a small amount built in, but if you’re regularly with $5,000-plus worth of inventory at an off-premises location, you need the inland marine coverage.”

3. Event sales commercial insurance

Retailers who sell products at events, fairs, or markets need insurance tailored to these environments:

- Product liability insurance

- Event liability insurance

- Stallholders insurance

- Property insurance

- Transit insurance

If you sell at trade shows, festivals, markets, and other events, you might be covered by the event host or venue.

“Offline selling at trade shows [may] use the insurance provided by the venue, as they’re liable for situations that occur on their property,” says Vince Lefton, CEO of Bulldog Adjusters.

Always do your homework and check out your unique situation. Again, because you’re traveling and not selling at your primary location.

You can choose short-term coverage periods to accommodate your event schedule.

How to get retail business insurance

Now that we have a rough idea of the types of insurance you’ll need (remember: always research your unique circumstances), the next step is to get it.

Before you get a quote, have the following information handy:

- Business location(s)

- Gross annual sales

- Types of products sold

- Number of employees

- Details about your property (owned or leased, square footage, type of construction)

- Vehicle information (if applicable)

- Past insurance claim history

Retail insurance providers

There are numerous insurance providers, each with its strengths and specialized services. Consider both national carriers and local agencies. Look for agents with experience in retail insurance, as they’ll understand your specific needs.

Walt Capell, president and owner of Workers Compensation Shop, recommends finding an insurance agent you can trust and having an in-depth conversation about your business needs.

“Work with an independent agent who can quote multiple insurers and play them against each other to get the best possible value (coverage + price),” recommends Matthew A. Struck, partner at Treadstone Risk Management.

You’ll also want an agent who can “provide risk management advice to help prevent claims from happening, to make your business a more attractive one to insure and drop future insurance costs.”

Walt agrees that working with an independent agent will help retailers get the best coverage and value.

They can shop your policy around to multiple carriers, and they also have the knowledge about which carriers are actively looking to quote the coverages you’re looking for,” he says. “This can help you get bigger discounts.

It’s best to shop around for the best policy. Here are some retail insurance providers you can explore:

Choosing your insurance policy

Once you’ve gotten your quotes, you’ll need to compare policies and choose the best one.

“A good agent isn’t going to recommend coverage unless your business is truly at risk,” says Walt. “Insurance agents interact with people who are filing a claim on a daily basis. They know what it feels like for a business owner to have a fire or some other disaster and not have enough insurance coverage. When they recommend additional coverage, it’s usually because of one of these experiences.”

While shopping around, ask insurance agents about the following:

- Discounts: Some providers may offer discounts for bundling policies or implementing certain safety measures.

- Claims process: Understand how they handle claims and if the provider has a good reputation for fair and timely claims processing.

- Optional coverages: Inquire about additional coverages that might be beneficial, such as cyber liability or equipment breakdown insurance.

Retail insurance tips

Remember to never undervalue your inventory in hopes of getting a better deal.

“Insurance companies usually have endorsements that say if you were knowingly underinsuring, they could partially deny claims,” says Dave. “Look for insurance companies that will base your liability off square footage and number of employees rather than sales and payroll.”

Once you have your policy in place, you’ll want to make sure you’re making the best use of it—and that you stay protected.

“Confirm with your insurance company that they received the premium so that you know that your coverage has started,” says Lefton. “And don’t let your policy lapse.”

When purchasing your retail insurance policy, follow these four best practices:

1. Review policy details

Once you’ve selected a policy, review it thoroughly before signing. Ensure your business details are accurate and you understand the policy’s terms, including deductibles, coverage limits, and exclusions.

2. Keep it up to date

Regularly review and update your policy, especially when there are significant changes to your business, such as expansion, increased sales, or the addition of new products.

3. Maintain proper documentation

Keep a copy of your insurance policy and any related documents in a safe and accessible place. It’s also a good idea to digitally back up these documents.

4. Reevaluate annually

Business needs can change over time. Annually review your insurance coverage to ensure it remains adequate for your business. This is also an opportunity to see if better rates or more suitable policies are available in the market.

How much is retail insurance?

The cost of retail insurance varies based on several factors. Sharing an exact amount without specific details is difficult, but some providers offer rough estimates.

Retail insurance provider Insureon says retailers pay a median premium of about $65 per month, or $790 per year, for a business owner’s policy (BOP). This policy includes general liability insurance and commercial property insurance, usually at a lower rate than if the policies are purchased separately.

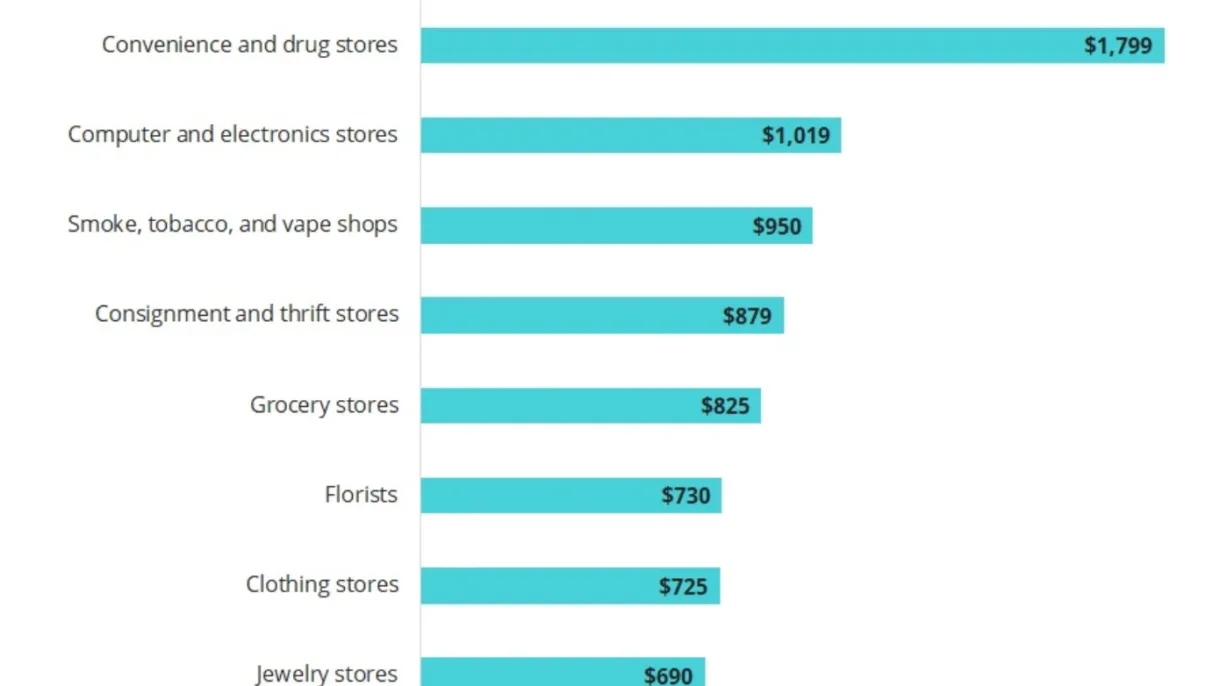

Annual retail business insurance costs vary by sector, too:

The cost of general liability insurance depends on a retail business’ risks. For example, smaller stores with fewer customer interactions face lower risks and pay less for this policy.

Insurance provider Progressive says the 2022 national median monthly cost of a business insurance policy for new Progressive customers ranged from $42 for professional liability insurance to $70 for workers’ compensation or a business owners policy (BOP).

Seven key factors influence the cost of retail insurance:

1. Type of coverage

A comprehensive insurance package that includes various coverage types such as general liability coverage, property insurance, workers’ compensation, and cyber liability may be more expensive than a basic general liability policy.

2. Size and location of the business

A large retail store in a high-rent, high-traffic urban area typically has higher insurance premiums than a small shop in a rural location.

3. Type of products sold

Selling products with higher potential risks, such as electronics or jewelry, may have higher premiums than low-risk items like books or clothing.

4. Business history

If your retail business has a history of frequent claims, your premiums might be higher. On the other hand, a clean claims record can result in discounts.

5. Number of employees

For coverages like workers’ compensation, the number and type of employees you have will play a role in determining the premium.

6. Deductibles

A higher deductible typically means a lower premium, but you’ll pay more out of pocket if you need to make a claim.

7. Security and safety measures

Implementing security systems, surveillance cameras, and safety measures can reduce the risk of theft, vandalism, and accidents, potentially lowering your insurance premiums.

Reduce risk with retail insurance

Retail insurance isn’t just a safety precaution; it’s an investment in the stability of your business.

Whether you run a bustling brick-and-mortar store or manage an expanding online retail shop, unforeseen challenges will arise. Equipping yourself with the right retail shop insurance will safeguard your business assets and secure peace of mind.

Get started with Shopify POS

Only Shopify gives you all the tools you need to manage your business, market to customers, and sell everywhere in one place. Unify in-store and online sales today.

What is retail insurance?

Retail insurance is a specialized type of business insurance tailored to the unique needs of retail businesses.

Whether you run a brick-and-mortar shop, an online store, or a mix of both, retail insurance helps protect your business from various risks associated with selling products to the public.

What kind of insurance do I need for my retail business?

The kind of insurance you need for your business depends on multiple factors, including the:

- Location of your business

- Type of products you sell

What are the 4 most common types of retail insurance?

The four most common types of retail insurance are:

- Property insurance

- General liability insurance

- Business interruption insurance

- Workers’ compensation insurance

Retail business owners should consult with an insurance agent to understand their business risks and the policy best suited to them.